Monopoly, Profits, and Public Burden

The Power Struggle Between Nova Scotia Power and Residents

SubOptimal – October 7, 2024

Monopoly Power and the Lack of Competition

At the core of the issue is the monopoly that Nova Scotia Power holds. As a regulated monopoly, the company is theoretically overseen by the Nova Scotia Utility and Review Board to ensure that electricity rates remain fair and that the service is reliable.

However, monopolies, even when regulated, are not subject to the forces of competition that would naturally drive prices down or encourage innovation. Without competitors, there is little market pressure for Nova Scotia Power to cut costs or improve service.

Nova Scotia Power can argue that rate hikes are necessary for maintaining infrastructure, investing in renewable energy, and addressing rising fuel costs. These reasons, while valid in some cases, can be viewed as insufficient justification for the consistent rate increases seen over the years.

Yet without the pressure of competition, there is little incentive for the company to optimize its operations or reduce costs, leaving consumers with no choice but to accept higher prices. This creates a cycle where the company passes the burden onto consumers without any competitive check.

Peter Gregg, the CEO of Nova Scotia Power, pictured, enjoyed a 65% pay raise in 2023. Total compensation that year? $1.73 million. Look how happy he is. Warms my heart. Not my house though.

The Justification of Rate Hikes

Nova Scotia Power has frequently justified its rate hikes by citing the need for infrastructure upgrades, renewable energy projects, and external cost pressures, such as fuel prices. These arguments may hold some merit, as maintaining an aging electrical grid and transitioning to greener energy sources are legitimate expenses.

However, critics argue that the costs passed on to consumers through these rate hikes are disproportionate. This is especially concerning when considering the company’s consistent profitability and regular shareholder returns.

The monopoly’s structure allows Nova Scotia Power to pass on these expenses without meaningful scrutiny. Consumers, having no alternative providers, are left with no choice but to accept these rising costs.

Government Intervention: A $500 Million Bailout

The Nova Scotia government’s recent decision to provide a $500 million bailout to Nova Scotia Power to avoid a further rate hike underscores the power imbalance between the company and the public. While the government’s intervention temporarily prevented an immediate increase in electricity rates, it also transferred the financial burden from ratepayers to taxpayers, raising questions about long-term sustainability.

Public funds are being used to maintain the company’s financial stability, effectively subsidizing a private corporation while failing to address the structural issues within the electricity market.

This approach also sets a problematic precedent. Rather than holding Nova Scotia Power accountable for its financial management and operational decisions, the government has capitulated to the company’s demands for financial support.

The bailout signals that, when faced with the threat of further rate hikes, the government is willing to step in with public money rather than enforce more stringent regulatory measures or demand corporate accountability.

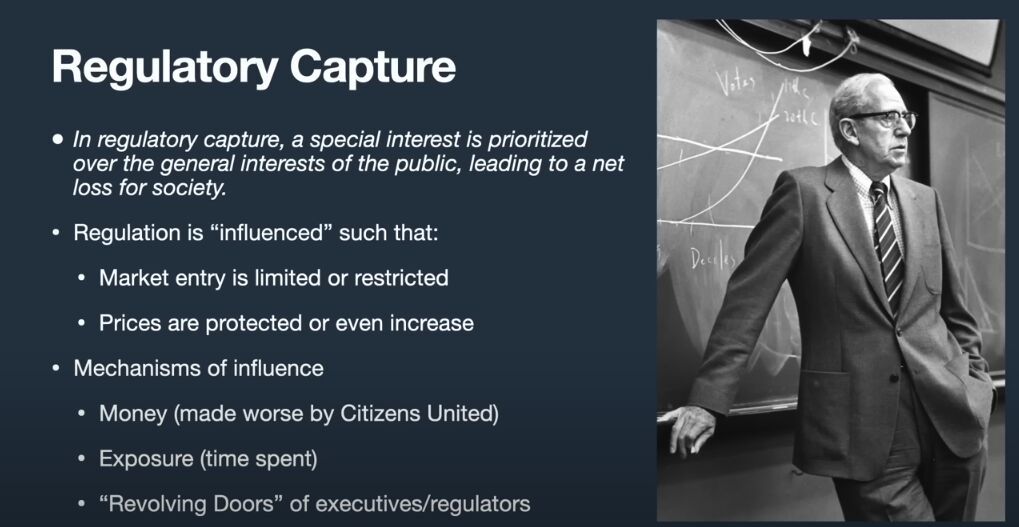

Regulatory Capture and Public Interest

The issue of regulatory capture is highly relevant in this context. The Nova Scotia Utility and Review Board, responsible for regulating Nova Scotia Power and approving rate hikes, must balance the company’s financial needs with the public’s interest in affordable energy.

However, there is concern that the board may be more aligned with the interests of the utility than with those of the general public. This alignment is not unique to Nova Scotia; regulatory capture is a well-documented phenomenon where regulatory agencies become influenced or dominated by the industries they are supposed to regulate.

This dynamic makes it difficult to prevent excessive rate increases, as the regulatory body may approve hikes that are more favorable to the utility than to consumers.

Public Subsidies for Private Profit

One of the most striking aspects of the government’s intervention is how it highlights the conflict between public interest and private profit. Nova Scotia Power, as a subsidiary of Emera, is a for-profit entity that regularly distributes dividends to shareholders.

Yet, when faced with the prospect of significant rate hikes, the government stepped in to provide financial support. This effectively uses public funds to maintain private profitability, raising serious questions about the role of government in subsidizing essential services provided by private corporations.

The expectation is that public funds should be used to benefit the broader population, not to shield a monopoly from financial consequences or protect corporate earnings.

The Broader Implications

The monopoly held by Nova Scotia Power, combined with its ability to secure public funds to avoid unpopular rate increases, creates a troubling dynamic. Consumers are left paying ever-increasing rates for electricity, while the government absorbs additional costs to prevent public discontent.

Meanwhile, the company continues to generate profits and distribute dividends, with little incentive to change its practices.

The broader implications of this situation extend beyond electricity rates. The government’s willingness to provide financial support to Nova Scotia Power without demanding significant reforms reflects a broader trend, where corporate interests often take precedence over public well-being.

As long as the utility remains a monopoly with minimal competition, it will continue to raise rates. The public will bear the financial burden, either directly through higher electricity bills or indirectly through taxpayer-funded bailouts.

Potential Solutions

Addressing this issue requires a multi-faceted approach.

First, the regulatory framework must be strengthened to ensure that rate hikes are scrutinized more rigorously. The Nova Scotia Utility and Review Board should be empowered to demand greater transparency from Nova Scotia Power regarding its operational costs and long-term financial planning.

Additionally, the government could explore alternative energy solutions, such as encouraging decentralized renewable energy production through community solar or wind projects. These initiatives could provide consumers with alternatives to Nova Scotia Power, injecting much-needed competition into the energy market.

Another potential solution is to consider public ownership of the utility. In other Canadian provinces, such as Manitoba, publicly owned utilities have been successful in keeping rates low and ensuring that profits are reinvested into the system, rather than distributed to shareholders.

Public ownership could help align the utility’s financial incentives with the public interest, reducing the reliance on rate hikes to generate profits.

Conclusion

The ongoing rate hikes by Nova Scotia Power, coupled with the government’s recent $500 million bailout, highlight significant concerns about the intersection of monopolistic power, corporate profits, and public accountability.

As long as Nova Scotia Power remains a regulated monopoly with minimal competition, it will continue to seek rate increases, and the public will be left with few options.

Without stronger regulatory oversight, increased competition, or a shift toward public ownership, the cycle of rate hikes and public bailouts is likely to continue, to the detriment of consumers and taxpayers alike.

Would you like to contribute?

If you have information on government and corporate waste, excess, cronyism, illegal activities, etc, we want to hear from you. At EhThics.com, we’re committed to exposing the truth. Please email your story ideas or tips to [email protected] —your insights can help us shine a light on the issues that matter most.